Table Of Content

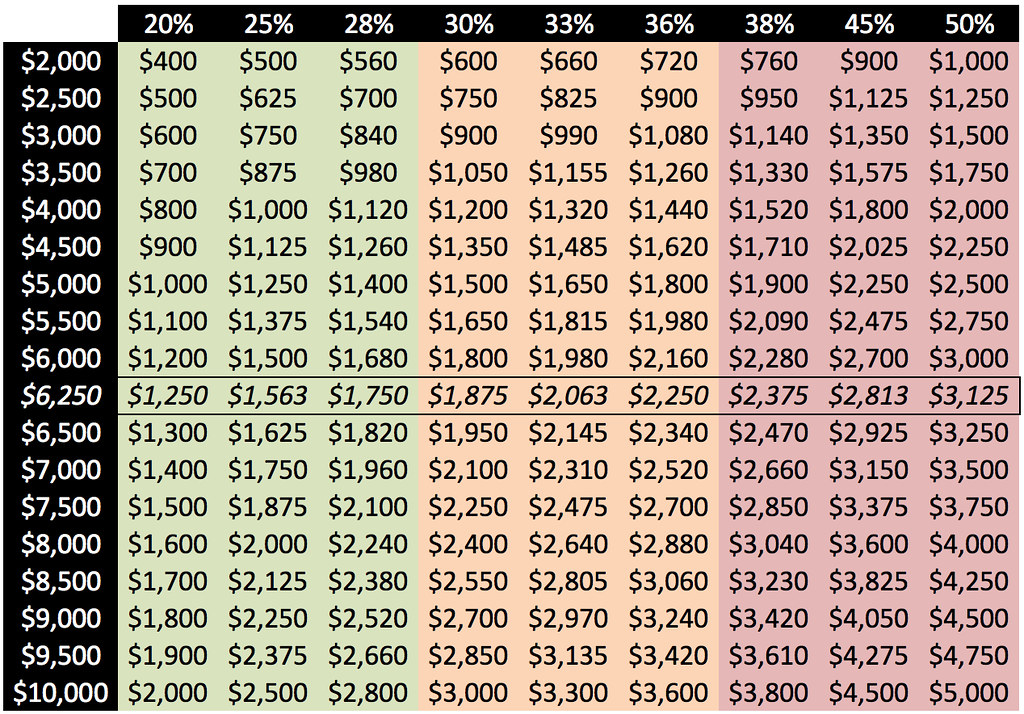

You’ll stop paying PMI when your mortgage reaches about 78% of the home’s value. With a 15-year mortgage at a 5% interest rate, your monthly payment would be around $2,500 (that’s only principal and interest). To cover that payment, you’d need to earn a monthly take-home pay of at least $10,000 ($2,500 is 25% of $10,000).

How much is homeowners insurance and what does it cover?

After you run the numbers, consider your situation and think about your lifestyle—not just now but into the next decade or two. If you are willing to compromise a bit on things like this, you can often score lower home prices. Here is everything you need to consider to determine how much you can afford. Among the weapons that could go very quickly are the 155 mm rounds and other artillery, along with some air defense munitions. The official spoke on the condition of anonymity to discuss preparations not yet made public. Those systems cost more to replace, so the military — in particular, the Army — went deeper into debt.

Comprehensive Guide to the USDA Home Loan

If lenders determine you are mortgage-worthy, they will then price your loan. Your credit score largely determines the mortgage rate you’ll get. The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. For example, some experts say you should spend no more than 2x to 2.5x your gross annual income on a mortgage (so if you earn $60,000 per year, the mortgage size should be at most $150,000).

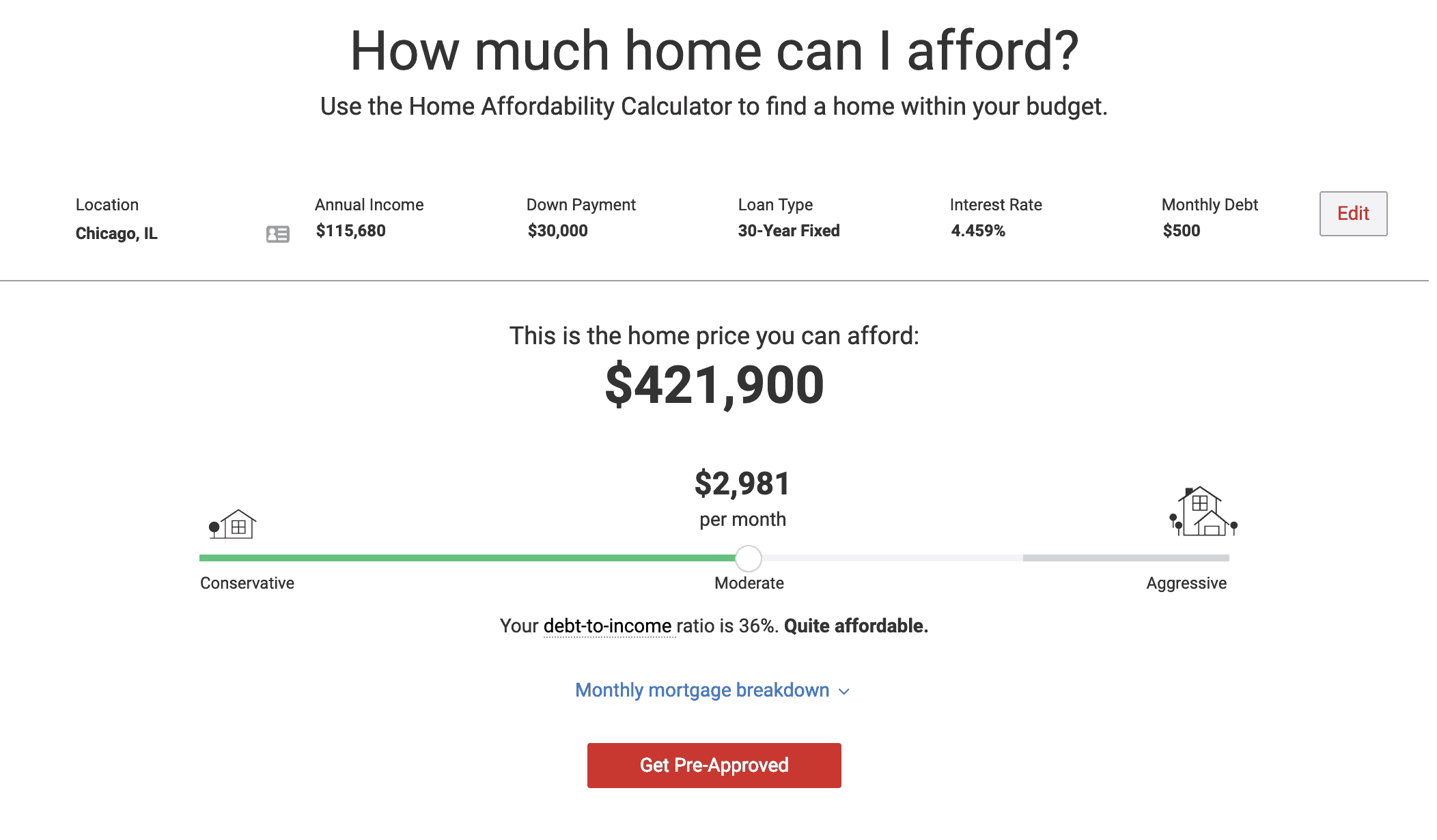

Calculate your affordability

You have to make the mortgage payments each month and live on the remainder of your income. Most banks don’t like to make loans to borrowers with higher than a 43% debt-to-income ratio. Although it’s possible to find lenders willing to do so (but often at higher interest rates), the thinking behind the rule is instructive. You could save a bigger down payment to lower your monthly mortgage payment until it’s no more than 25% of your take-home pay. Or you could look for a smaller starter home in a more affordable neighborhood.

This means your money is going toward your actual debt and not interest on that debt. It’s important to remember that if you don’t manage to pay down the debt before the 0% APR offer ends, you might end up with a higher interest rate on your debt than you had before. It’s important to remember that the mortgage lender is only telling you that you can buy a house, not that you should. That’s why it can make a significant difference if you make even small extra payments toward the principal, or start with a bigger down payment (which of course translates into a smaller loan). While maintaining a debt-to-income ratio under 36% protects you from minor changes in your finances, a cash reserve protects against major ones.

Dave Ramsey Insists 'If You Can't Afford A Home On A 15-Year Mortgage, It Means You Can't Afford The House. Period ... - Yahoo Finance

Dave Ramsey Insists 'If You Can't Afford A Home On A 15-Year Mortgage, It Means You Can't Afford The House. Period ....

Posted: Mon, 12 Feb 2024 08:00:00 GMT [source]

California's best mortgage lenders

Generally, there’s no universally-set figure for how much a monthly mortgage payment would be for a $700K home. But assuming you make a 20% down payment on a $700,000 home with a 30-year, fixed-rate mortgage at a 7% rate, the monthly payment for principal and interest would work out to $3,726. This does not include expenses such as homeowners insurance, property taxes or HOA fees. Mortgage insurance protects the mortgage lender against loss if a borrower defaults on a loan.

Mortgage lenders are required to assess your ability to repay the amount you want to borrow. A lot of factors go into that assessment, and the main one is debt-to-income ratio. The mortgage calculator lets you click "Compare common loan types" to view a comparison of different loan terms.

Knowing your house budget and sticking to it is the only way to make sure you get a mortgage you can pay off as fast as possible. So, when you’re figuring out how much house you can afford, don’t forget to factor saving for emergencies into the equation. For more on the types of mortgage loans, see How to Choose the Best Mortgage. Our partners cannot pay us to guarantee favorable reviews of their products or services. If one side of the affordability coin is income, then the other side is your debt. Complete or change the entry fields in the "Input" column of all three sections.

That way, if you experience a loss of income and need to find a new job, or if you decide to sell your house, you have plenty of time to do so without missing any payments. There are several ways you can make buying a home more affordable. Some of the best include increasing your income, decreasing your monthly payment by making a bigger down payment, and moving to a more affordable neighborhood. So, to buy a $400,000 home, your annual take-home salary would have to be more than $120,000 ($10,000 x 12 months). But you’d actually need more than that after adding in the cost of property taxes and home insurance. The home affordability calculator provides you with an appropriate price range based on your input.

Your proposed housing payment, then, could be somewhere between 26% and 35% of your income, or $1,820 to $2,450. VA loans are partially backed by the Department of Veterans Affairs, allowing eligible veterans to purchase homes with zero down payment (in most cases) at competitive rates. Homeowners in some developments and townhome or condominium communities pay monthly Homeowner's Association (HOA) fees to collectively pay for amenities, maintenance and some insurance.

From there, you can test out different loan terms to see which one is the most manageable for your current income. As a homeowner, you’ll pay property tax either twice a year or as part of your monthly home payment. This tax is a percentage of a home’s assessed value and varies by area. For example, a $500,000 home in San Francisco, taxed at a rate of 1.159%, translates to a payment of $5,795 annually.It’s important to consider taxes when deciding how much house you can afford. When you buy a home, you will typically have to pay some property tax back to the seller, as part of closing costs.

Your other two options, pay off debt and increase income, take time. Perhaps you need to make a budget and a plan to knock out some of your large student or car loans before you apply for a mortgage. Or you wait until you get a raise at work or change jobs to apply for a mortgage. Read more on specialized loans, such as VA loan requirements and FHA loan qualification. In addition, take a look at the best places to get a mortgage in the U.S. You can also check out current mortgage rates in your area for an idea of what the market looks like.

That monthly payment is likely to be the biggest part of your cost of living. Gross monthly income is the total amount of money you earn in a month before taxes or deductions. But, think of it this way, you’ll improve your chances for a favorable mortgage, which is usually 30 years of your life. Waiting a few years to put yourself in a better position is just a fraction of time compared to the many years you’ll spend paying your monthly mortgage bill. At a minimum, it’s a good idea to be able to make three months’ worth of housing payments out of your reserve, but something like six months would be even better.

Fixed-rate loans have the same interest rate for the entire duration of the loan. That means your monthly home payment will be the same, even for long-term loans, such as 30-year fixed-rate mortgages. Two benefits to this mortgage loan type are stability and being able to calculate your total interest on your home upfront. The problem is that some people believe the answer to “How much house can I afford with my salary? ” is the same as the answer to “What size mortgage do I qualify for? ” What a bank (or other lender) is willing to lend you is definitely important to know as you begin house hunting.

Many lenders use this ratio to determine if you can afford a conventional home loan without putting a strain on your finances or causing you to go into default. The 28/36 rule also protects borrowers as much as it protects lenders, as you’re less likely to lose your home to foreclosure by overspending on a home. Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford.

No comments:

Post a Comment